The #StartupAus Crossroads report is a valuable body of work. Over the past four years, the annual research has been the definitive approach to apply non-partisan critical thinking towards Australia’s startup landscape.

#StartupAus operates under a vision to “Develop a world-leading tech startup ecosystem in Australia”. Crossroads is the annual report with recommendations that advocate progress towards this vision. The audience for the report include those in the loosely bound innovation ecosystem, made up of government agencies, innovation hubs and programs, investors and financial institutions, university, researchers, and education providers, corporations and industry bodies. The report’s intent is to focus attention and advocate and influence change in policy, behaviour, and culture.

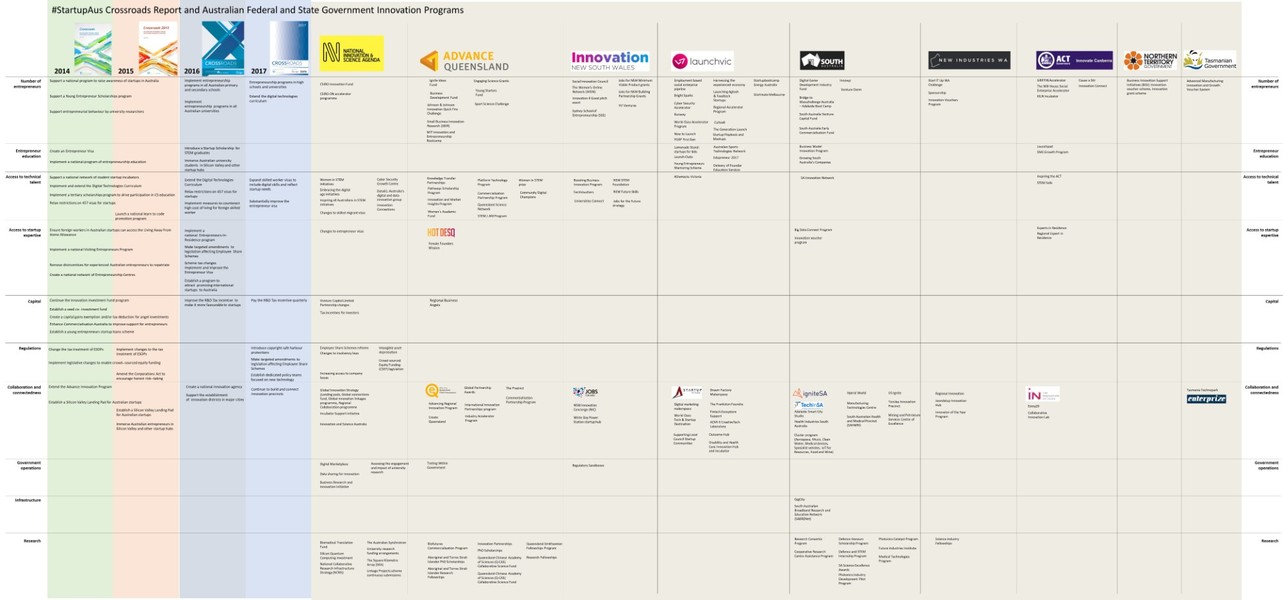

One of the reasons or my focus on mapping and measuring the Australian innovation ecosystem is to consider the impact and effectiveness of government innovation programs. So I decided to map how the Crossroads recommendations have changed over time, where current government programs align with the recommendations, and differences between the emphasis on different government programs.

This is not intended to be comprehensive or perfect. I outline a number of caveats below. Feedback is always welcome. My intent is to share my ongoing progress for those who might benefit.

Apologies for the image format, you will need to zoom or view image in a separate tab for detail.

For a more succinct Crossroads critical review and thoughts on “so what”, you can read Steve Baxter’s take on R&D, Visas and talent, and Employee Share Schemes.

Caveats

As with any interpretation, some caveats apply:

- Category crossover: The categories are open to interpretation. Programs can be in more than one category, with an accelerator creating more entrepreneurs, providing access to startup expertise, and providing capital. Research programs can also commercialise and provide access to technical skills. Simply having a gap in a category may be a result of a different interpretation.

- Completeness: The list is based on the content of the Crossroads reports and initiatives listed by the innovation program portfolio each government website. There are likely programs that have been missed. There are also programs within programs, such as Queensland’s Industry Accelerator Program which funded multiple accelerators or spaces.

- Inclusion: The focus is on programs aimed at helping entreprenurs with businesses that can scale, as compared to traditional small business support programs. Programs included were listed under the innovation portfolio of the government website. There are other portfolios particularly in State governments such as investment attraction and economic development. There may be programs that are missing that could benefit a startup, and others that made it into the government portfolio that may not be relevant to a startup.

- Current: The list is a point in time, with new programs coming in and others on their way out. The aim is to compare where government effort is focused and determine what should be done next.

- Federal and State focus: The programs are focused at the federal and state level. I also acknowledge great work being done at the local city level, including Melbourne, Sydney, Adelaide, and Brisbane.

- Non-government and other portfolios: More work is being done than just government programs. Examples of state-wide efforts in the US can be seen coming from private groups like the Kauffman Foundation in Kansas and Brad Feld in Colorado. I also acknowledge other Australian bodies of work including the annual Australian Chief Economist’s Australian Innovation System Report and the Startup Muster survey. These reports provide a good outline of current state, while Crossroads is unique in its position of moving beyond base information and providing strong advocacy.

- Role of government, founder-first: Government programs are good to focus attention and lead where the market is not incentivised as a first mover. Ultimately the ecosystem needs to be founder led to be sustainable. This work only demonstrates where government is focusing attention, not a complete picture of what is happening in the ecosystem. Many of the great initiatives across Australia and globally are built from entrepreneurs leading the way.

Comments on the categories

The rationale for the categories is below. The first group of categories are based on Crossroads recommendations:

- Number of entrepreneurs: Startups is a numbers game. Traditionally high failure rates means throwing more entrepreneurs in the mix increases the likelihood of success. This includes accelerator programs, awareness campaigns, pitch events, and early stage young founder grants. This is also the catch all for the majority of the various grant programs.

- Entrepreneur education: Programs designed to educate entrepreneurs, often through action and other entrepreneurs. Higher quality entrepreneurs increases the likelihood of success and return on investment into programs.

- Access to technical talent: Technology is required to build a scalable, high growth business. Programs to build STEM capability and provide access to those with STEM skills help entrepreneurs execute faster.

- Access to startup expertise: More than just educating entrepreneurs, we need access to those with practical experience. In consulting to regions, I often hear the statement “blind leading the blind”. Initiatives to bring in visiting entrepreneurs from other regions and take local entrepreneurs overseas are helpful.

- Capital: Initiatives in the capital category are not aimed at providing capital, but creating the framework for capital to flow such as developing local angel groups or changing tax policy. Money from government in the form of grants have been categorised under the intended purpose, usually to increase the number or capability of entrepreneurs.

- Collaboration and connectedness: Ecosystems require a glue to hold each element together. Connecting organisations emerge in each region, such as the Office of the Queensland Chief Entrepreneur, StartVic, Meshpoints in WA, and Canberra’s CRB Innovation Network. Physical spaces, clusters, and other associations also fall in this category.

The next three categories are based on government programs that did not fit into areas based on the Crossroads recommendations:

- Government operations: As with any institution, governments can require internal innovation. Programs in this category are aimed at internal improvements, often accessing the open market for assistance.

- Infrastructure: Entrepreneurs require high speed internet to compete on a global market.

- Research: Some programs focus on pure research or building capability for researchers, particularly when commercialisation is costly.

The online source of the programs are listed below. Some of the States I have less information on. Northern Territories supports all businesses through their Start, Run, Grow program. Tasmania published a 2010 Innovation Strategy. Other states have dedicated innovation programs.

- Innovation NSW

- ACT Innovate Canberra

- LaunchVic

- Advance Queensland

- Innovation SA

- Western Australia New Industries Fund

- Tasmania Department of State Growth

- Northern Territories Start, Run, Grow

More questions

Grouping programs helps understand the collective strategy, how each government aims to execute on the strategy, and how we might measure outcomes. It is an input to my current body of work, rather than an outcome, but I thought is was perhaps interesting enough to publish.

Given the expected gaps in the infograph, I will hold off on making observations based on what each state is doing. What is interesting is similarities and differences in the approach each state has to realising a shared objective.

Other questions that come up include:

- Are we creating more entrepreneurs?

- Are we educating entrepreneurs to improve success rate and make failure less costly?

- Do entrepreneurs have access to the necessary technical skills?

- Are the capital channels open for all communities?

- How do these outcomes vary based on the strategy taken by each government?

- What was the role of government as compared to university and the private market?

These questions and more will continue to be answered as we progress with mapping and measuring outcomes. As always, feedback, input, and collaboration is welcome.